For years, the semiconductor industry has largely operated under the shadow of TSMC’s formidable foundry dominance, particularly when it comes to the bleeding edge of chip manufacturing. But now, a new contender steps into the ring with an ambitious, high-stakes bet: Intel’s 14A process node. Announced at the Intel Foundry Direct 2025 event, 14A isn’t just another incremental step; it’s a make-or-break moment that has the industry buzzing with a potent mix of excitement and deep-seated skepticism. For PC gamers, the success or failure of 14A is nothing short of pivotal. It could usher in a new era of competition, innovation, and potentially better availability and pricing for the CPUs and GPUs that power our rigs, or it could simply reinforce TSMC’s near-monopoly, shaped by Intel’s past struggles and a newly cautious, demand-driven strategy. This is more than just a technological race; it’s a battle for the future of gaming hardware.

Intel’s Foundry Dream: A History of Ambition and Hurdles

Intel’s journey to reclaim its manufacturing crown has been a saga of ambitious pronouncements and often, challenging realities. Under CEO Pat Gelsinger, the company famously declared its “five nodes in four years” strategy, a bold roadmap aiming to deliver Intel 7, 4, 3, 20A, and 18A in rapid succession. Fast forward to 2025, and the results are decidedly mixed. Intel 7 turned out to be a rebrand of their long-struggling 10nm node, while Intel 4 and 3, though in production, have seen limited application, primarily confined to specific internal CPU designs like the Meteor Lake’s CPU tile. Most notably, the ambitious Intel 20A node was quietly cancelled, a stark reminder of the immense hurdles in advanced semiconductor manufacturing. These historical stumbles – the delays, the rebrands, and the outright cancellations – are precisely what fuel the deep skepticism now surrounding Intel’s latest and arguably most critical venture: 14A.

Intel’s Process Node Roadmap: Promises vs. Reality

2020

Pat Gelsinger appointed CEO, ambitious ‘five nodes in four years’ plan announced (Intel 7, 4, 3, 20A, 18A).

2025 (Current)

Intel 7 (rebrand of 10nm) and Intel 4/3 (limited use) in production. Intel 20A cancelled. 18A in risk production, volume later this year. 14A PDK distributed to Apple/NVIDIA.

2027

Targeted risk production for Intel 14A and 14A-E.

2028-2029

Projected 14A volume production, contingent on ‘hero customer’ commitments.

What is 14A and Why Does it Matter for Gamers?

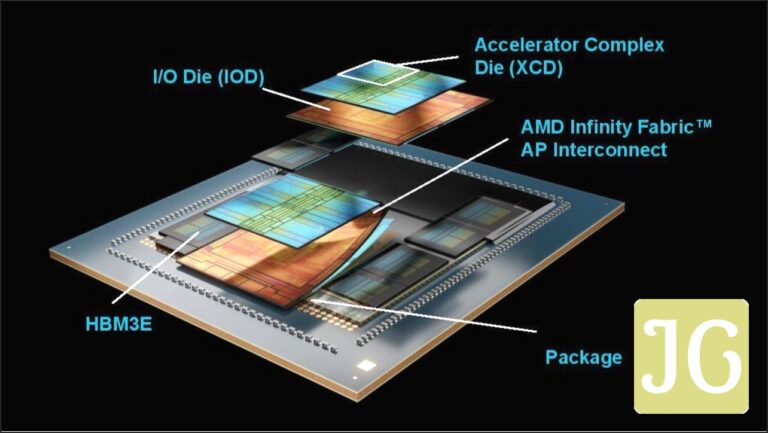

At its core, Intel 14A is the projected successor to Intel’s 18A node, representing the company’s next-generation, cutting-edge manufacturing process. Announced at the recent Intel Foundry Direct 2025 event, it’s slated for risk production in 2027. But for gamers, 14A is far more than just a technical designation. Intel is projecting some truly significant gains: up to a 35% reduction in power consumption, a 15-20% boost in performance-per-watt over 18A, and a 1.3X increase in transistor density. These aren’t just abstract numbers; they directly translate to the future of our gaming experiences.

Should Intel succeed with 14A, it could fundamentally reshape the PC gaming hardware market. Imagine more efficient CPUs that run cooler and faster, or GPUs that deliver higher frame rates without demanding more power. Crucially, a viable Intel foundry offering could introduce much-needed competition to TSMC, potentially leading to better availability of components, more competitive pricing, and accelerated innovation cycles as both giants push the boundaries of what’s possible. Conversely, if 14A falters, it risks solidifying TSMC’s near-monopoly, which could translate to slower innovation, higher prices, and continued supply chain vulnerabilities for the very components that define our gaming PCs.

Under the Hood: 14A’s Game-Changing Tech

PowerDirect: Redefining Power Delivery

One of the most significant architectural leaps in 14A is the implementation of PowerDirect, Intel’s second iteration of backside power delivery. Traditionally, power and data lines compete for space on the front side of the wafer, leading to congestion and signal integrity issues. PowerDirect flips this paradigm, routing power directly from the back of the chip to the transistors. This innovative approach dramatically reduces power consumption by minimizing resistance and inductance, while also cutting down on electromagnetic interference (EMI) – a critical factor for stable, high-performance operation. Intel claims this second-gen backside power delivery positions 14A two generations ahead of TSMC, whose first iteration of backside power is only expected around 14A’s projected launch. This could give Intel a crucial efficiency edge.

RibbonFET 2: The Next-Gen Transistor

Complementing PowerDirect are Intel’s next-generation RibbonFET 2 transistors. Building on the Gate-All-Around (GAA) architecture, RibbonFET 2 utilizes a stacked nanosheet design where the gate completely encircles the transistor channel. This innovative structure significantly improves transistor density and enables faster switching speeds by maximizing the gate control over the channel. The unique ability to adjust and merge these nanosheets allows designers to create wider ribbons for maximum drive current, directly contributing to 14A’s projected performance gains and overall power efficiency—a critical factor for delivering more frames per second in your favorite games.

Turbo Cells & Flexible Libraries: Performance Unleashed

Beyond the foundational transistor and power delivery innovations, Intel 14A introduces “Turbo Cell” technology and a suite of flexible standard cell libraries. Turbo Cells are a game-changer for chip designers, offering a customizable approach to maximize CPU frequency and significantly boost performance for those critical “speed paths” within GPUs. These paths are the longest timing routes in a processor, often acting as bottlenecks to overall frequency. Unlike traditional methods that might sacrifice density for speed, Turbo Cells allow architects to strategically blend faster, more power-hungry cells with power-efficient ones within the same design block. This granular control ensures an optimal balance of power, performance, and area (PPA) for diverse applications.

Further enhancing this flexibility are three distinct standard cell libraries: a “tall” library for ultimate high frequency (at the cost of density and leakage), a “mid-size” library balancing performance per watt, and a “short” library prioritizing maximum transistor density, crucial for the compact designs of modern CPUs and GPUs. Notably, Turbo Cells are specifically engineered to boost performance within these high-density “short” libraries, even allowing for double-height libraries while maintaining area efficiency. This comprehensive approach empowers designers to fine-tune chips for specific gaming workloads, potentially unlocking unprecedented levels of optimization.

High NA EUV: The Lithography Advantage

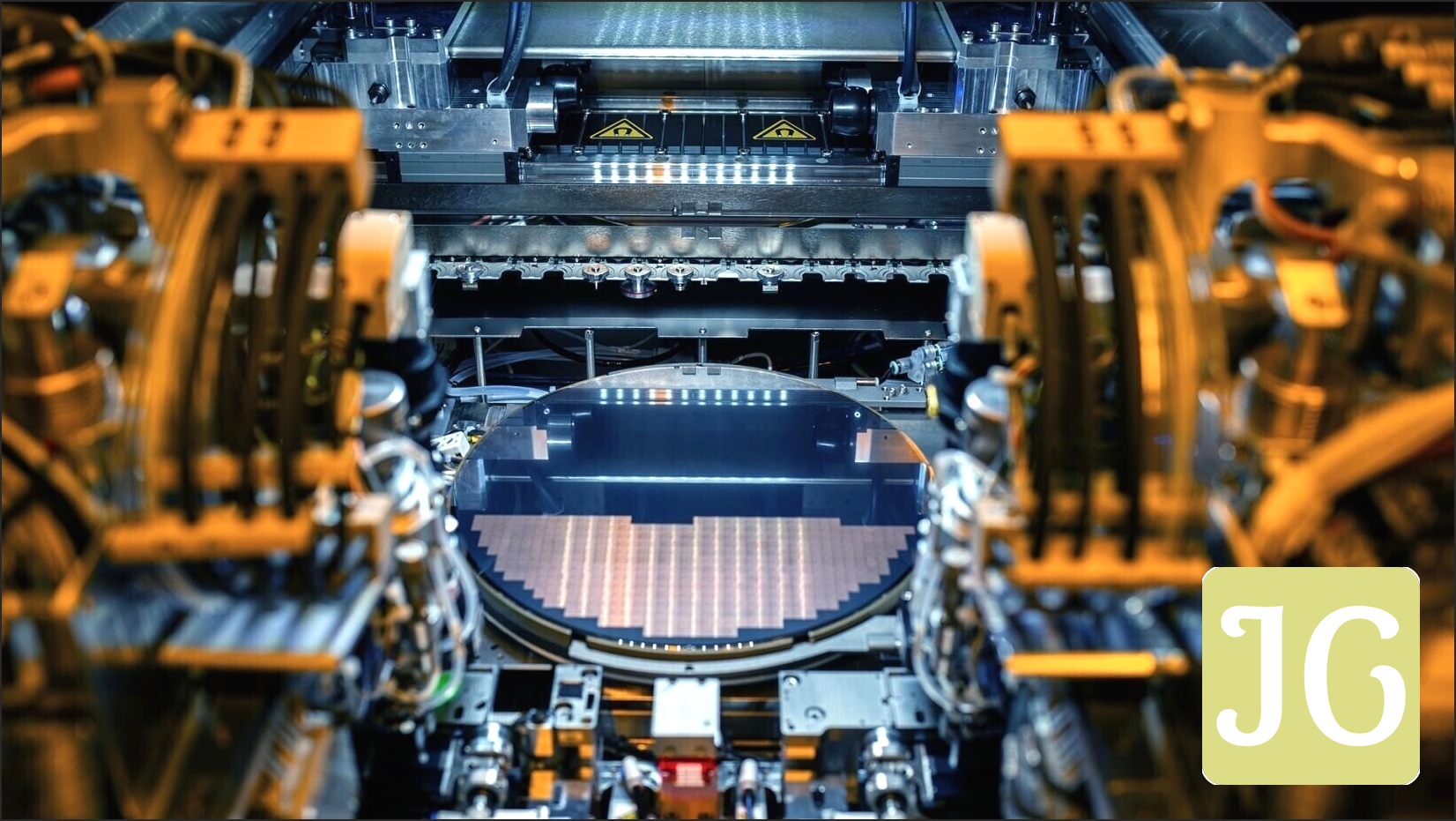

The sheer complexity and ambition of 14A also necessitate the most advanced manufacturing tools on the planet. Intel’s 14A process is set to heavily rely on ASML’s cutting-edge High NA EUV (Extreme Ultraviolet) lithography machines, specifically the Twinscan EXE:5000/5200 tools, which come with a staggering price tag of over $380 million each. These machines are revolutionary, offering an 8-nanometer resolution, a substantial leap from the 13.5-nanometer resolution of current EUV machines. This vastly improved precision is what allows for the increased transistor density and efficiency promised by 14A, enabling more complex and powerful designs to be etched onto silicon. Without the capabilities of High NA EUV, the advancements targeted by 14A would simply not be possible.

Intel 14A vs. TSMC: The Spec Sheet Showdown (Intel’s Projections)

Intel 14A

- ✓ Successor to 18A

- ✓ Up to 35% power reduction / 15-20% performance-per-watt increase vs. 18A

- ✓ 1.3X transistor density vs. 18A

- ✓ Features PowerDirect (2nd Gen backside power), RibbonFET 2, Turbo Cells

- ✓ Utilizes High NA EUV lithography

- ✓ Targeted Risk Production: 2027

TSMC (N3E/N2)

- ✓ Current leading-edge (N3E), upcoming (N2)

- ✓ Established high-volume production

- ✓ First iteration of backside power delivery expected around 14A launch

- ✓ Dominant market share, proven execution

- ✓ Highly diversified client base

The ‘Hero Customer’ Hunt: Apple, NVIDIA, and the TSMC Shadow

The success of Intel’s 14A node hinges entirely on securing a “hero customer” – a significant external client whose commitment can justify the immense investment. This is where industry titans Apple and NVIDIA enter the narrative. Reports indicate that both companies have received 14A Process Design Kits (PDKs) and are actively considering trial production. For Apple, this move aligns with a broader strategy to diversify its supply chain and mitigate single-supplier risk, particularly concerning its powerful M-series chips. A dual-foundry approach offers resilience against geopolitical tensions or manufacturing hiccups. For NVIDIA, the interest lies in potentially leveraging 14A for its entry-level GPU lines, signaling a desire to explore alternative manufacturing capabilities for a segment of its product stack.

These engagements are crucial for Intel, especially given CEO Lip-Bu Tan’s explicit new “demand-driven” strategy for 14A. Unlike past “build-first” approaches, future spending on 14A is now strictly contingent on confirmed external orders. Tan has made it clear: without viable client commitments, the 14A process could be paused or even canceled. This places immense pressure on Intel to prove its capabilities and secure these high-profile customers, transforming their interest into tangible orders.

No More Blank Cheques: Intel’s New Reality

Under CEO Lip-Bu Tan, Intel has undergone a profound strategic shift. The era of “blank cheques” for manufacturing capacity is over. Tan has explicitly stated that spending on the 14A node is now entirely contingent on confirmed external orders. Without viable client commitments, the process could be paused or even canceled. This new reality is reflected in broader financial restructuring: a reduction in capital expenditure, significant job cuts, and the abandonment of previous global expansion plans, including the cancellation of new factory projects in Germany and Poland, and a substantial delay for the Ohio fab from 2025 to 2030. Every investment, Tan insists, must now make economic sense.

The Road Ahead: Risks, Rewards, and the 2028/2029 Deadline

The road ahead for Intel’s 14A node is paved with both immense opportunity and significant risk. Bernstein & Co. analyst Stacy Rasgon points to a critical 18-month deadline for Intel to secure that elusive “hero customer” for 14A, which is currently slated for production around 2028 or 2029. Intel itself has been unusually candid, publicly stating that a failure to land a substantial external customer would render 14A’s development uneconomical, potentially leading to its discontinuation, along with future leading-edge nodes and even manufacturing expansion projects. Rasgon cautions that this frank admission, while transparent, could inadvertently deter prospective clients who might question Intel’s long-term commitment.

However, Intel CEO Lip-Bu Tan remains outwardly confident. He reports an increase in early customer engagement and excitement, suggesting a more collaborative approach where Intel works closely with potential clients to ensure 14A meets their specific needs. This engagement is vital. It’s a delicate balancing act: Intel must demonstrate both its technical prowess and its financial prudence, all while navigating the skepticism fueled by its own past. The coming months will be crucial in determining whether 14A becomes a cornerstone of a revitalized Intel Foundry or another ambitious plan left unfulfilled.

What 14A Success (or Failure) Means for Your Next Gaming PC

Potential Upsides: Competition, Supply, Innovation

- ✓ Increased competition to TSMC could lead to better pricing and availability for gaming CPUs and GPUs.

- ✓ Faster innovation cycles as foundries push each other.

- ✓ More diverse supply chain, reducing risk of single-point failures (e.g., geopolitical tensions affecting one region).

Potential Downsides: Delays, Monopoly, Pricing

- ✘ If Intel fails, TSMC’s near-monopoly could solidify, potentially leading to higher prices and slower innovation.

- ✘ Further delays in advanced node adoption could impact next-gen gaming hardware launches.

- ✘ Continued reliance on TSMC means less supply chain diversification.

Ultimately, Intel’s 14A node stands as a critical juncture, not just for the company, but for the entire gaming hardware ecosystem. It’s a high-stakes gamble that could dramatically reshape the landscape. On one hand, it represents Intel’s most tangible path yet to regaining foundry leadership, introducing genuine competition to TSMC’s long-held dominance, and fostering an environment ripe for accelerated innovation, better supply, and potentially more accessible pricing for the next generation of gaming CPUs and GPUs. On the other hand, should 14A falter amidst the industry’s skepticism and Intel’s historical execution challenges, it could simply solidify TSMC’s near-monopoly, leaving gamers with fewer choices and potentially slower advancements. The stakes couldn’t be higher. We at JoltGamer will be closely monitoring every development, so stay tuned for the latest updates on this pivotal battle for the future of silicon.

Your 14A Questions Answered

How does Intel’s 14A node truly compare in terms of performance, power efficiency, and cost to TSMC’s current (N3E) and upcoming (N2) nodes?

▾

Based on Intel’s projections, 14A aims for significant improvements over 18A (15-20% perf/watt, 1.3X density). While direct, independent comparisons to TSMC’s N3E/N2 are not yet available, Intel’s PowerDirect is positioned as second-gen backside power, potentially ahead of TSMC’s first iteration. Cost-effectiveness remains a key challenge for Intel.

What specific performance and efficiency benefits could 14A offer for gaming CPUs and GPUs, particularly for NVIDIA’s ‘entry-level’ lines?

▾

The 14A’s advancements like PowerDirect, RibbonFET 2, and especially Turbo Cells (designed to boost CPU frequency and critical paths in GPUs) promise higher clock speeds or lower power consumption. For NVIDIA’s entry-level GPUs, this could mean more performance at a given power budget, or better efficiency for mobile gaming devices, making advanced graphics more accessible.

What are the actual risks and contingency plans for Apple and NVIDIA if Intel struggles with 14A yields or cost-effectiveness during trial production?

▾

Both Apple and NVIDIA are likely pursuing a dual-foundry strategy to mitigate risk. If Intel struggles, their primary reliance on TSMC would continue. Trial production itself is designed to identify and address these issues before volume commitments. The risk for them is primarily investment in design adaptation and potential delays, not a complete product failure, as they have backup plans.

If successful, how quickly could 14A scale to volume production and genuinely impact the broader market for gaming hardware components?

▾

Intel targets risk production in 2027, with volume production projected for 2028-2029. Scaling to volume production for a new node is a complex process. Even with success, a significant market impact (e.g., widespread availability of 14A-based gaming CPUs/GPUs) would likely not be seen until the early 2030s, assuming Intel secures substantial external orders and executes flawlessly.

Is this a genuine long-term diversification strategy by Apple and NVIDIA, or primarily a short-term leverage play against TSMC?

▾

It’s likely a combination. For Apple, diversifying its supply chain is a long-term strategic goal to reduce single-supplier risk. For both, engaging with Intel also provides leverage in negotiations with TSMC, potentially leading to better terms or capacity. The long-term commitment will depend on Intel’s ability to consistently deliver on performance, yield, and cost.