Considering your next gaming GPU upgrade? You’re likely wondering what the latest headlines about geopolitical tensions and tech trade wars mean for your wallet and your wishlist. The answer, unfortunately, is a complex web of ripple effects. A mounting backlog in U.S. Commerce Department export license approvals, specifically impacting billions of dollars worth of Nvidia’s crucial AI chips like the H20, is creating a supply chain quagmire. This isn’t just about data centers; it’s a bureaucratic bottleneck that could indirectly but significantly influence the availability and pricing of consumer PC gaming hardware, including the highly anticipated RTX 50-series.

Your Gaming Future: Potential Impacts at a Glance

RTX 50-Series Launch Delays?

Potential shifts in release timelines for Nvidia’s next-gen gaming GPUs.

Current & Future GPU Pricing

Possible price increases or slower declines for existing and upcoming cards.

Availability & Stock Levels

Reduced supply of high-end gaming GPUs due to production prioritization.

The Geopolitical Quagmire: What’s Really Happening?

Understanding the Export License Backlog

The Core Problem: Stuck Shipments

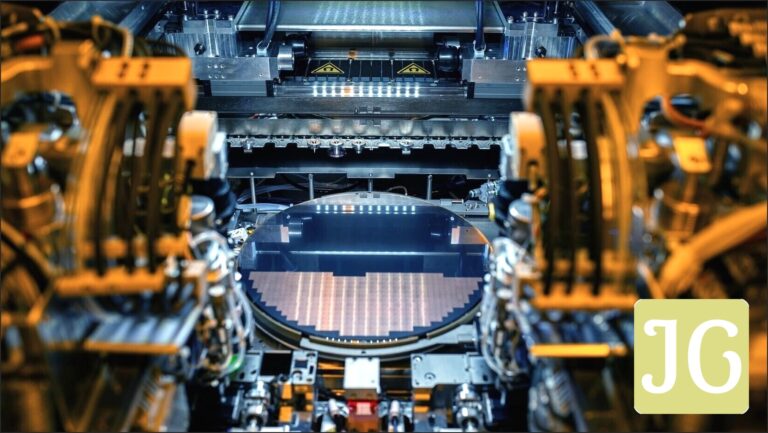

At the heart of this market uncertainty lies a bureaucratic bottleneck within the U.S. Commerce Department. Officials, speaking to Reuters, describe the current export license backlog as the worst in over 30 years, holding up billions of dollars worth of crucial technology. Among the most prominent casualties are Nvidia’s H20 AI GPUs, specifically designed for the Chinese market under U.S. export controls. These licenses are a mandatory hurdle, and without their approval, shipments of hundreds of thousands of these high-value chips remain in limbo, stalling lucrative deals.

Why the Hold-Up? Internal Chaos

The reasons for this unprecedented delay are multi-faceted and point to significant internal dysfunction. Cited causes include deep staffing cuts, ongoing communication issues, and continued vacancies in critical positions, including China-based export control offices. Sources within the department allege micromanagement by Jeffrey Kessler, the BIS undersecretary who took office in March. Kessler is accused of urging staff to limit direct communication with companies and industry officials, demanding all meetings be meticulously logged in a central spreadsheet, and even being difficult to schedule for his own meetings. This internal chaos has stretched the average license application response time from 38 days in 2023 to far longer in 2025, risking long-term U.S. business interests as Chinese companies begin to seek alternative suppliers.

China’s Concerns: Trackers and Trust

Adding another layer of complexity are China’s own concerns regarding the very GPUs they wish to import. The Cyberspace Administration of China has flagged Nvidia’s H20 AI GPU as a potential spying risk, even summoning Nvidia to discuss fears of built-in backdoors or trackers that could prevent resale or allow unauthorized remote access. While Nvidia maintains its chips have no such backdoors, the U.S. government itself has entertained proposals, like one from Senator Tom Cotton, to mandate location-tracking technology on high-end GPUs to prevent them from falling into ‘adversaries’ hands. This climate of distrust, against a backdrop of tumultuous U.S.-China trade relations and ongoing terse negotiations, further complicates the path for these critical AI chips.

The Nvidia Nexus: How AI Delays Ripple into Gaming

Nvidia, now the most valuable company in the world, has fundamentally shifted its strategic focus. While still a dominant force in gaming, its immense profits—with net income increasing by a staggering 109% year-over-year—are overwhelmingly driven by the insatiable demand from the AI and data center segments. Indeed, Nvidia’s data center division alone contributed approximately 87.7% of its total revenue, reaching $30.7 billion. This lucrative pivot means that fab capacity and component allocation are increasingly prioritized for high-margin AI chips, such as the H100, H200, and upcoming Blackwell B100/B200. This prioritization, combined with the current export license delays holding up billions in H20 AI GPU orders, creates a tangible ripple effect on the consumer gaming market. Nvidia CFO Colette Kress warned of a potential gaming GPU supply shortfall for the current quarter, noting that while gaming revenue was healthy ($3.3 billion in Q3, up 15% year-over-year), supply would be tight. She did, however, express expectations for supply to improve in early 2025. This dynamic underscores a critical point: when AI demand is at its peak and bureaucratic delays compound supply issues, gaming GPUs, while still important, may take a backseat in the production queue, impacting what’s available on store shelves and at what price.

RTX 40-Series Wind-Down Meets 50-Series Anticipation

Nvidia is actively winding down production of most RTX 40-series GPUs, leading to decreasing stock and existing shortages, particularly for high-end models like the RTX 4090. This strategic move is in clear preparation for the next generation. All signs point to Nvidia revealing the first consumer Blackwell GPUs, specifically the highly anticipated RTX 5090 and RTX 5080, at CES 2025 in January.

The Domino Effect: Pricing, Availability, and the Competition

Potential Scenarios for Gaming GPU Market Impact

| Scenario | Impact on RTX 50-series Launch | Impact on Current RTX 40-series Pricing | Overall Availability Outlook |

|---|---|---|---|

| Best Case: Swift Resolution | Minimal delays, on track for CES 2025 reveal. | Prices stabilize, potential for holiday deals. | Gradual improvement in supply into 2025. |

| Moderate Case: Lingering Delays | Minor delays to launch, initial stock limited. | Prices remain elevated, slow decline. | Tight supply for high-end cards through Q1 2025. |

| Worst Case: Prolonged Standoff | Significant delays, staggered launch, or limited models. | Prices increase further, especially for high-end. | Severe shortages, difficult to find desired models. |

While Nvidia grapples with geopolitical headwinds and prioritizes its immensely profitable AI sector, a window of opportunity could open for its competitors, AMD and Intel. Should the export license backlog continue to constrain Nvidia’s overall production capacity or delay the RTX 50-series launch, AMD, with its Radeon RX series, and Intel, with its Arc lineup, could strategically capitalize. By maintaining consistent supply and potentially offering more aggressive pricing, they could attract gamers frustrated by Nvidia’s availability issues or inflated prices. This situation could foster a healthier competitive landscape, giving consumers more viable alternatives and potentially pushing innovation across the board, rather than relying solely on a single dominant player.

What This Means for Your Next Upgrade: A JoltGamer Outlook

Crucial Points for Gamers

- AI demand is now Nvidia’s primary driver, potentially impacting gaming GPU allocation.

- The RTX 50-series launch timeline and initial availability could be volatile due to global supply chain pressures.

- Current-gen RTX 40-series prices and stock will remain sensitive to market dynamics and wind-down strategies.

- Keep a close eye on AMD and Intel offerings; they might become increasingly attractive alternatives.

Your Next GPU Purchase: Navigating the Uncertainty

Should You Buy a GPU Now?

If your current GPU is struggling and you need an upgrade soon, now might be a pragmatic time to buy a current-gen RTX 40-series card, particularly if you find a good deal on a bundled gaming PC or laptop. While discrete card prices haven’t dropped significantly, the market is seeing a wind-down of RTX 40-series production. This means stock for certain models is decreasing, and waiting too long could mean limited availability or even higher prices for remaining inventory. Don’t expect deep discounts on high-end 40-series cards, but mid-range options might be worth considering.

Waiting for the RTX 50-Series?

If you’re eyeing the cutting-edge RTX 50-series, prepare for potential volatility. While the RTX 5090 and 5080 are widely expected to be revealed at CES 2025, initial stock could be limited, and prices will likely be premium, especially for the flagship models. Lower-end 50-series cards aren’t anticipated until later in 2025. If you can hold out, monitoring early reviews and stock levels will be crucial. Be ready to act fast if a desirable model appears, but also be prepared for potential delays or price adjustments based on the evolving supply chain.

Keep an Eye On…

Beyond Nvidia, closely watch AMD’s Radeon RX series and Intel’s Arc GPUs. Any significant supply constraints or price hikes for Nvidia’s cards could make these alternatives more competitive and appealing. Subscribe to stock alerts from major retailers, follow JoltGamer’s market analysis for real-time updates, and consider if your performance needs can be met by a slightly older generation or a competitor’s offering if the 50-series launch proves turbulent. Flexibility will be your greatest asset in this uncertain market.

Your Questions Answered

Will the RTX 50-series be delayed?

While Nvidia is still expected to reveal the RTX 5090 and 5080 at CES 2025, the ongoing export license backlog for their AI chips and the strategic shift towards AI production could introduce delays or limit initial launch availability for consumer gaming GPUs. It’s a volatile situation.

Will GPU prices go up?

The combination of Nvidia prioritizing highly profitable AI chips, the wind-down of RTX 40-series production, and potential supply constraints from the export backlog could lead to elevated prices for both current and upcoming GPUs, or at least slower price declines than typically expected.

Is this affecting all GPUs or just Nvidia?

The primary direct impact is on Nvidia, specifically its H20 AI GPUs caught in the U.S. export license backlog. However, Nvidia’s dominant market position means that any disruption to its supply chain or production priorities can create ripple effects across the entire gaming GPU market.

What about AMD/Intel?

This situation could present an opportunity for AMD and Intel to increase their market share. If Nvidia’s supply remains tight or prices rise, AMD’s Radeon RX series and Intel’s Arc GPUs could become more attractive alternatives for gamers seeking an upgrade.

How long will this last?

The U.S. Commerce Department’s export license backlog is described as the worst in over 30 years, with no clear timeline for resolution. While Nvidia expects gaming GPU supply to improve in early 2025, the broader geopolitical and bureaucratic issues risk bleeding into the medium and long-term, potentially leading to permanent shifts in global supply chains.

About Samuel Ross

A veteran of the tech industry, Samuel Ross has the rare ability to connect the dots between a silicon-level innovation and the real-world FPS gamers actually experience. He doesn’t just report on new technology; he explains its context and what it signals for the future of the market. Readers turn to Samuel for insightful analysis that answers not just ‘what’ is happening, but ‘why’ it matters for their next upgrade.